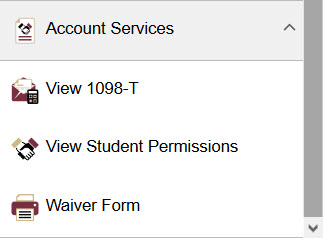

Account Services

The Account Services folder provides you with access to your tax information, financial aid permissions, and university graduate waiver form.

View 1098-T

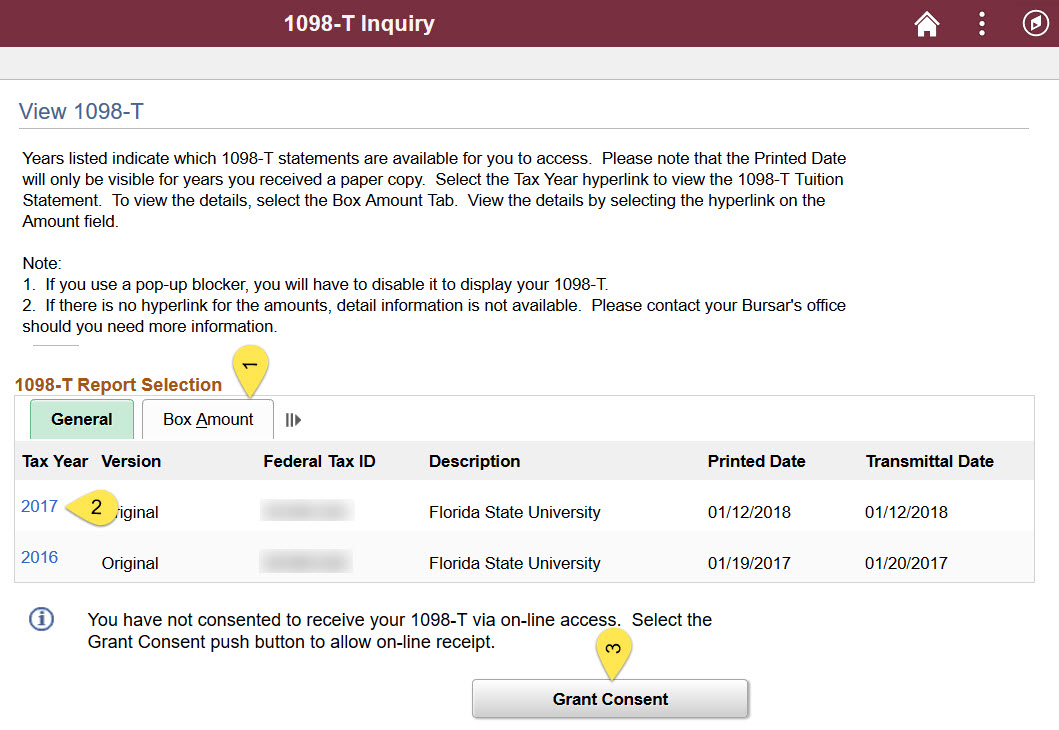

The 1098-T tax form provides you with information about your payments and financial aid for the tax year, and is used to complete your federal income taxes. You can read more about the 1098-T on our website.

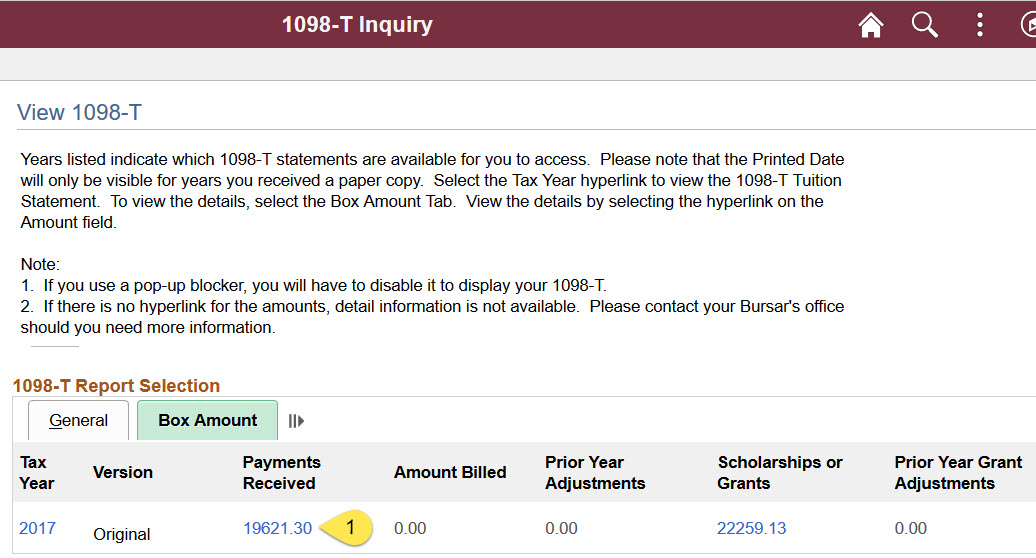

1: The 1098-T provides both summary and detailed information. The actual form itself will only provide you with summary data for payments and financial aid, but clicking on the "Box Amount" tab will allow you to see the detail behind the numbers on your form.

2: To download a PDF copy of your 1098-T tax form, click the tax year you'd like to retrieve.

3: If you've never granted consent for the University to provide you your 1098-T electronically and not print and mail it to you, please do! You'll help us cut costs to the University and save some trees!

1: On the "Box Amount" tab, click on the hyperlinked amount that you'd like detail behind.

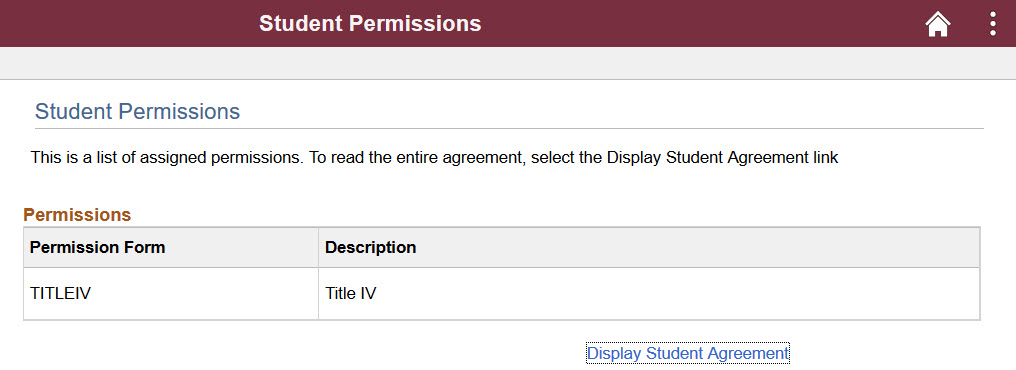

View Student Permissions

Federal law requires that universities request permission to use your federal financial aid (loans, grants, etc.) to pay for charges that are not related to tuition and housing (like health insurance, parking citations, international programs travel, etc.). If you'd like for the University to use your federal financial aid to pay these charges, complete the Title IV permission. If you've already completed this permission, you can view your signed agreement here.

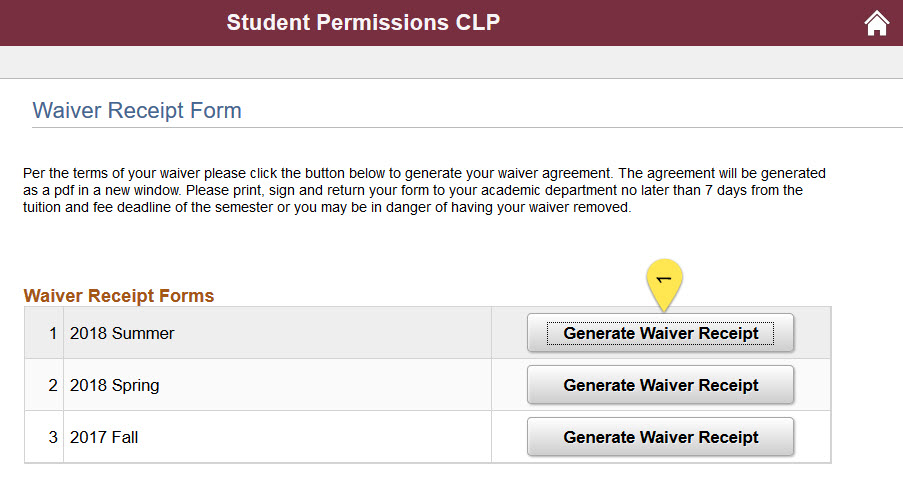

Waiver Form

Graduate, teaching, and research assistants are required to sign a waiver form every semester acknowledging the requirements for their University matriculation or out of state waiver. This form can be downloaded here, signed, and returned to your academic department.